Physical and mental fatigue is constant

Recognizing Persistent Fatigue in Your Daily Routine

One of the most telling signs that retirement might be approaching is a constant sense of physical and mental fatigue. If you find yourself waking up tired, struggling to get through the workday, or lacking the energy you once had for both your job and personal life, it could be more than just a busy week. This ongoing exhaustion can impact your health, emotional well-being, and even your relationships with colleagues and family.

Many people in the later stages of their career notice that recovery from stress or illness takes longer. This is not just about age, but also about the cumulative effects of years spent working. When fatigue becomes the norm rather than the exception, it may be a sign to consider retirement planning more seriously.

- Difficulty concentrating or making decisions at work

- Feeling emotionally drained after routine tasks

- Needing more time off or sick days to recover

- Reduced motivation to engage in social or leisure activities

Persistent fatigue can also signal deeper health issues that may require attention. It is important to assess whether your current job is affecting your long-term health and if it is time to retire or adjust your work-life balance. Taking a day off work can sometimes help, but if rest no longer restores your energy, it may be a sign that you have reached retirement age or should start thinking about your retirement benefits and health care options. For more on the importance of taking breaks and recognizing when you need time away from work, see this resource on effective reasons to take a day off work.

Recognizing these signs early can help you plan for a secure retirement, ensuring your financial and emotional needs are met as you transition from working life to senior living.

Your passion for work has faded

When Your Job No Longer Inspires You

One of the most telling signs it might be time to consider retirement is when your passion for your work starts to fade. Many people begin their careers with energy and enthusiasm, but over time, the daily grind can wear down even the most dedicated professionals. If you find yourself going through the motions, lacking motivation, or feeling emotionally detached from your job, these are important emotional signs that your career may have reached a natural turning point.

This loss of passion can impact more than just your job performance. It often seeps into other areas of life, affecting your emotional well-being and your relationships with colleagues, friends, and family. You may notice that you no longer look forward to work-related challenges or that achievements in your job no longer bring the same sense of satisfaction. These feelings can be a signal that you are ready to retire or at least start retirement planning.

- Feeling disconnected from your work or company mission

- Struggling to find meaning in daily tasks

- Decreased interest in professional development or new projects

- Increased daydreaming about retirement benefits, retirement income, or senior living options

It’s important to recognize these emotional shifts as valid indicators that you may be ready for a new chapter. If you’re also noticing other signs, such as constant fatigue or health issues, it could be time to consider retirement more seriously. Consulting with a financial advisor can help you assess your retirement savings, retirement age, and overall financial security before making any decisions. And if you’re wondering how changes in your work schedule or paid time off might impact your transition, you can learn more about how direct paid time off impacts your work-life balance.

Remember, losing passion for your job isn’t a failure. It’s a natural part of a long career and can be a helpful sign that you’re ready to retire and focus on new goals, whether that’s travel, volunteering, or simply enjoying more time with loved ones.

Health issues are becoming harder to manage

When Managing Health Becomes a Daily Challenge

As people approach retirement age, one of the most telling signs it might be time to retire is when health issues start to interfere with daily life and work. While everyone experiences occasional aches or stress, persistent health concerns—whether physical or emotional—can make it increasingly difficult to keep up with job demands. If you find yourself needing more time off for doctor visits, or if your energy levels are consistently low, these could be clear indicators that your body is signaling a need for change.

Chronic stress from work can also impact your emotional well-being, leading to burnout or anxiety. This not only affects your performance but can also spill over into your personal life, making it harder to maintain a healthy work-life balance. In fact, countries with strong work-life balance policies often see better health outcomes among their senior workforce, highlighting the importance of supportive environments as you consider retirement planning.

- Frequent health care appointments that disrupt your work schedule

- Difficulty recovering from minor illnesses or injuries

- Increased reliance on health insurance and medical benefits

- Emotional signs like irritability or feeling overwhelmed by job tasks

It’s important to recognize these signs and seek help when needed. Consulting a health professional or a financial advisor can provide guidance on whether you’re ready to retire and how to secure your retirement benefits and income. Remember, your health is a key factor in determining when it’s time to consider retirement, and prioritizing it can lead to a more fulfilling senior living experience.

Work-life balance is impossible to maintain

When Work-Life Balance Slips Out of Reach

One of the most telling signs that retirement may be approaching is when maintaining a healthy work-life balance feels impossible. Many people start their careers with energy and drive, but over time, the demands of the job can begin to overshadow personal life. If you find that work consistently intrudes on your time with family, friends, or personal interests, it may be a signal that it’s time to consider retirement.

- Constant Overtime: If you’re regularly working late or bringing work home, it can take a toll on your emotional and physical health. This ongoing strain can make it difficult to recover, leading to burnout and decreased job satisfaction.

- Missing Important Life Events: Skipping family gatherings, social events, or even neglecting your own hobbies can be a sign that your job is taking too much from your personal life. Over time, this imbalance can affect your relationships and overall happiness.

- Declining Health: As mentioned earlier, health issues can become harder to manage when work takes priority over self-care. Chronic stress from a poor work-life balance can worsen existing conditions and make it harder to enjoy your senior years.

- Emotional Signs: Feeling irritable, anxious, or emotionally drained after work is not uncommon, but if these feelings persist, they may indicate that you’re ready to retire. Emotional well-being is just as important as financial security in retirement planning.

Reaching retirement age is not just about numbers or financial readiness. It’s also about recognizing when your job is no longer compatible with your desired lifestyle. If you feel that your career is preventing you from enjoying life outside of work, it may be time to explore retirement options, review your retirement benefits, and consult a financial advisor to ensure your retirement income and health insurance needs are met. Remember, achieving a balanced life is a key part of a fulfilling retirement journey.

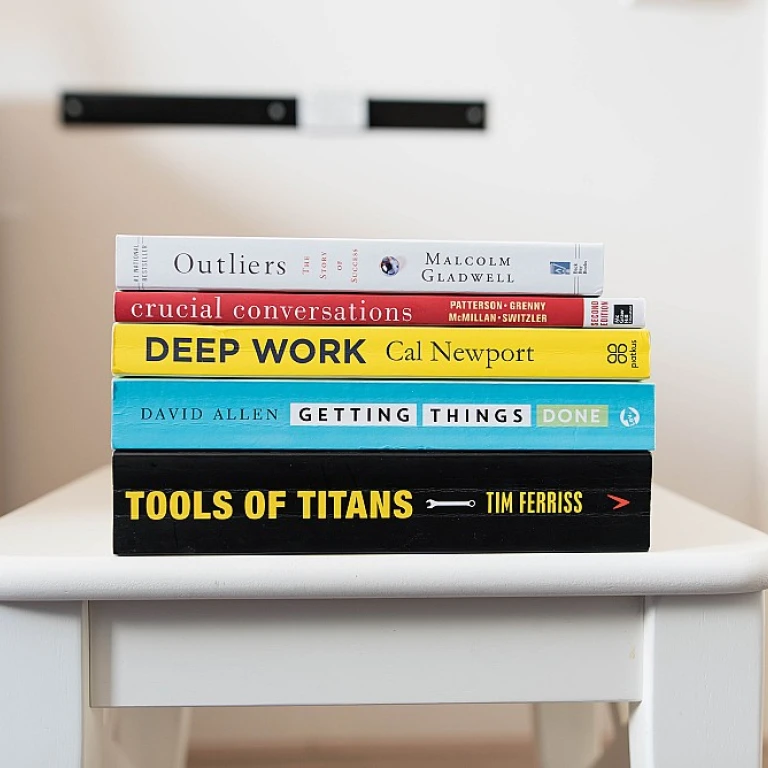

You’re financially prepared for retirement

Assessing Your Financial Readiness for Retirement

One of the most practical signs that it might be time to retire is feeling financially prepared. After years of working and saving, reaching a point where your retirement income and savings can support your desired lifestyle is a major milestone. This sense of security often comes after careful retirement planning and honest conversations about what you need to feel comfortable stepping away from your job.

- Retirement savings: If your retirement savings, such as 401(k)s, IRAs, or pensions, have reached a level that covers your expected expenses, it’s a strong indicator you may be ready to retire.

- Social Security and benefits: Understanding when you can claim Social Security and how much you’ll receive is crucial. Many people wait until full retirement age to maximize their benefits, but some choose to start earlier or later depending on their needs.

- Health insurance and care: Health care costs can be significant in retirement. If you have a plan for health insurance—whether through Medicare, a spouse, or private coverage—you’re better positioned for a secure retirement.

- Income security: Reliable sources of retirement income, such as annuities or rental properties, can provide peace of mind. If you feel confident that your income will last throughout your retirement years, it’s a positive sign.

- Consulting a financial advisor: Many people find it helpful to work with a financial advisor to ensure they’ve considered all aspects of retirement planning, from taxes to senior living options.

Financial readiness doesn’t just mean having enough money—it’s also about feeling secure and confident in your decision. If you’re noticing other emotional signs, such as a loss of passion for your career or ongoing health issues, these can reinforce your sense that it’s time to consider retirement. Ultimately, being financially prepared helps reduce stress and allows you to focus on enjoying life after work.

Colleagues and family notice changes in you

When Others Notice the Shift

Sometimes, the signs that it might be time to retire are most obvious to those around you. Colleagues, friends, and family can often spot changes in your attitude, energy, or overall well-being before you do. If people close to you are expressing concern about your health, work-life balance, or emotional state, it’s worth paying attention. These observations can be a valuable signal that your current job or career may no longer be serving your best interests.

Here are some common ways others might notice you’re approaching retirement age or that you’re ready to consider retirement:

- Family members mention you seem more tired or stressed after work

- Colleagues ask if you’re okay or comment on changes in your mood or performance

- Friends encourage you to take more time for yourself or pursue activities outside of your job

- Supervisors or HR may bring up retirement planning, retirement benefits, or discuss your future plans

These external observations can help you reflect on your own feelings about your career, health, and financial security. If you’re hearing these comments more frequently, it may be a sign you’ve reached retirement readiness, or at least that it’s time to consider retirement planning more seriously. Consulting with a financial advisor or exploring your retirement income options, such as social security or health insurance, can provide additional clarity and help you make informed decisions about your next steps.

Remember, recognizing these emotional signs and seeking help or advice is a positive step toward a secure and fulfilling senior living experience. Listening to those who care about you can make the transition from working life to retirement smoother and more rewarding.